First – some politics!

I emigrated to the USA from the United Kingdom – where we have the National Health Service – an enormous system of socialized healthcare. That system is funded through a small tax that every working person pays, and because of centralized purchasing power the cost of providing this healthcare is relatively low for the care available.

The system in the USA is quite different. There are many, many very profitable private businesses within the healthcare industry and people here have a ridiculous sense of how much healthcare services should cost. A procedure in the USA will cost several times that cost incurred in most other countries in the world (a good comparison article here). Americans will sometimes tell you that is the because of the costs of malpractice insurance in this very litigious country. Well, that is only partially true. The reality is that the government has allowed private healthcare businesses to set their own pricing and now there are many people making a very good living from this rip-off.

The situation got out of hand so people were making healthcare choices based on their ability to pay. Many could not afford to have insurance and so when a serious health issue occurred people were literally going without healthcare for treatable illnesses that led to far more serious issues. Disgraceful and sad for a country that has so much. Things got a little better recently when President Obama pushed through the “Affordable Healthcare Act” (sometimes called “Obamacare”). It is far from perfect but at least it offered an affordable option and many that had previously not had insurance are now able to afford some coverage. There is a plan to require people to have insurance and even introduce fines through payroll taxes for people that refuse to get coverage. The reason for that is because the uninsured, sooner or later, had a health issue that would end up being an unpaid bill and those unpaid bills were costing everyone else money.

OK enough politics – how does healthcare in the US work now – particularly for new immigrants.

As I mentioned, everyone is required to have healthcare. This is sometimes provided through your employer and if they offer a plan it is probably the cheapest/best option – most companies will pay for some of the cost on your behalf (at least for the employee, if not the family). You can typically upgrade your plan to cover your family.

If your employee does not offer a healthcare plan (or you just want to decline their policy) you can shop around for an “ACA” approved plan and the first place to start shopping is the healthcare.gov website – you can get quotes from there very easily without entering much more than your family size and ages, and your household income. The income is important because there is a subsidy available depending on how much you earn. As your income rises you will be getting less and less subsidy of the monthly cost. I recommend you try getting quotes to see how that will work.

When you get quotes you will see several levels such as Bronze -> Silver -> Gold -> Platinum. The higher up that scale (Bronze is lowest, Platinum is highest) , the higher the monthly cost and the greater the benefit coverage (meaning less bills should you use healthcare). Yes folks, even though you have insurance, most insurance plans will still land you with a bill if you actually use healthcare. Great huh. Let me explain some of that…

The lower cost plans have higher deductibles, higher co-pay, and so on but with a limit or cap that you will be charged. Put it simply the low cost plans (Bronze for instance) will provide some comfort if you ever have a serious health event BUT leave you paying quite heavy fees for most services. You have to realize the “full” cost of health events is stunning. A simple broken leg with no overnight stay will cost $10k to $20k plus. Stay in hospital a few hours or overnight and you can be pushing $50/60k. Serious illnesses such as Cancer will cost hundreds of thousands of dollars and long term healthcare could see bills measured in the millions of dollars.

Deductible, copay, PPO, HMO – what the heck does that all mean??? Some of the terminology explained and a real example.

The two main types of healthcare insurance are HMO plans and PPO plans.

An HMO plan provides good coverage within a controlled environment. For instance, you see a doctor, if you need a specialist they will choose one of their allowable specialists and you will get the treatments the HMO approves. This type of plan is cheaper than a PPO, but is more restrictive – you have less choice of who provides your care and what care you receive. If for instance you need a newly available cancer treatment, you may find that is not approved and therefore not covered by the HMO.

A PPO plan is more expensive, but gives you more choice in your healthcare. You can see pretty much any doctor you like and get pretty much any treatment you like, although the PPO will cover more of the cost if that doctor/treatment is on their approved list.

A Deductible is the amount you will pay before your health insurance will start to pay.

A Co-Pay is the amount you will pay on certain standard services, like a GP visit (where a deductible doesn’t apply) or on other treatments that have a deductible once the deductible is met.

An Out of pocket maximum is set for an individual and a family. This is the maximum cost you will pay for deductibles and co-pays in a year. Once you hit that the plan covers the rest at 100%.

An example plan…

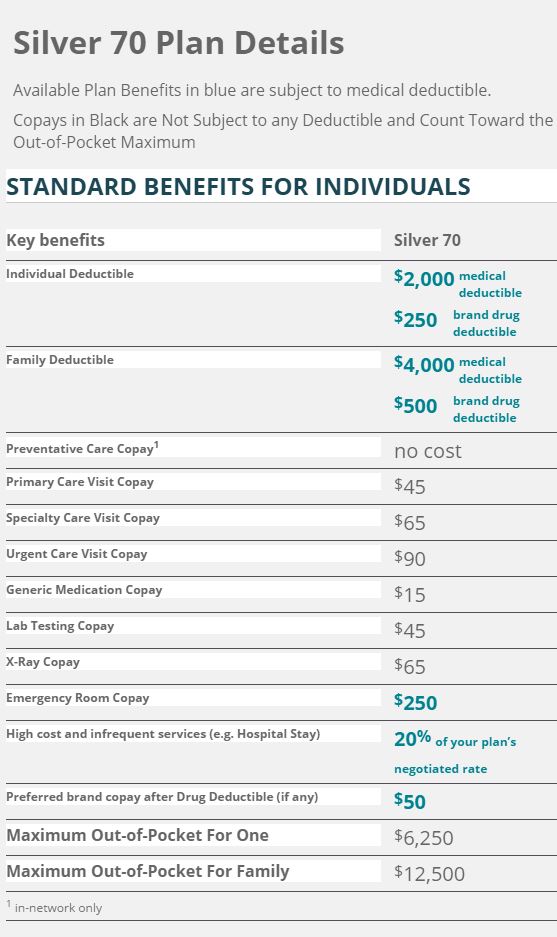

So – let’s say you buy a mid range plan such as shown below.

On the silver plan, seeing your doctor will cost you $45. If your doctor sends you for a blood test, that will be $45 more. If you need to see a specialist that will cost $65, but if you then need a treatment you will pay the first $2000 of the cost and then 20% of the bill after that, until you hit your out of pocket maximum of $6250 in one year. So – a plan like this will still cost money each time you see a doctor and if you have a more serious accident you will most likely hit your max out of pocket, but at least that accident wouldn’t mean going bankrupt.

By the way, the cost of the plan above for a family of three (35, 32 and a child) in California would cost $896 per month. If the family had a household income of $60k they would get a subsidy of $395 per month, leaving the plan costing $501 per month. If their household income was $85k or above they would not get the $395 subsidy at all.

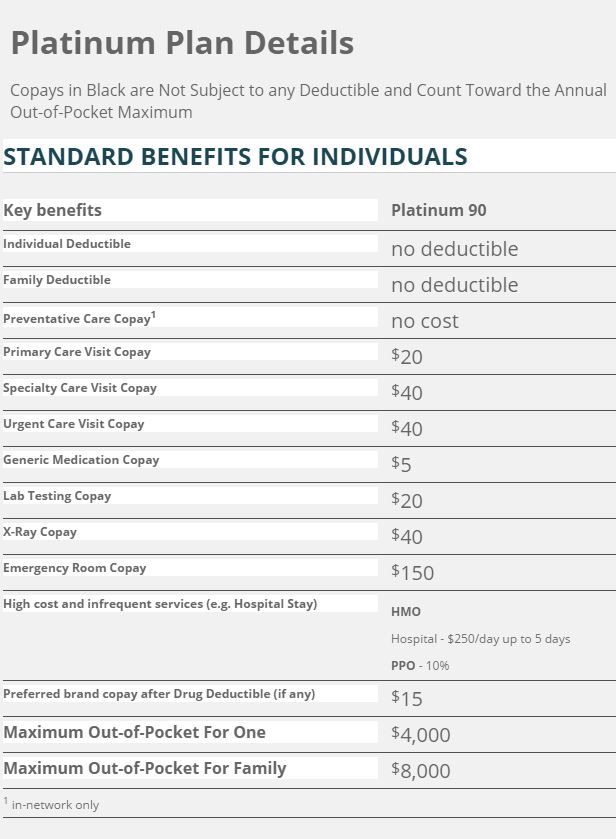

If you were to go for the more expensive plan ($1287 per month for the same example family unit), you can see how the exposure would reduce in the screenshot below. However, to be able to afford the $1287 per month your income would need to be substantially higher than the $60k household income.

Go on Healthcare.gov and get some quotes yourself…

What level of plan to choose?

Well that is a personal choice and you have to offset the affordability of the plan with your fear over the risk of a serious health incident OR your health situation. For example, if you have kids, you know they are likely to have an injury/illness or something and you will need to see the doctor. In that case you might want a plan that will cover that risk. If you are young, in good health, maybe you can gamble and go for a cheaper plan (bigger exposure if you have an accident). If your health is poor you might want to pay a bit more each month but lower your deductible and out of pocket maximum. If you are on a tight budget, look at HMO plans rather than PPO plans.

By the way, all ACA plans allow for 1 preventative physician visit per year – at no cost. To save money you can time that visit when you have some health issue going on to reduce or eliminate your costs.

I hope that helps!

March 22, 2016 at 17:48

Hello britsimonssys!

I’ve read your post about health care but I still have a problem about what to choose.

So, I’m young of 25 years old living NC.

I have a little Job and I need the cheapest plan

To avoid penalty at the end of the year.

By the way,is there any specific period of time to get health insurance or you get it whenever you want?

Thank you for your time!

March 22, 2016 at 17:54

In order to avoid the penalty you need an ACA approved plan. If you have made the move and are working, you should have the plan immediately. It is outside of the enrolment period but being a recent immigrant should allow you to enroll.

As for the choice of which plan – well you said your criteria – cheapest plan.

March 23, 2016 at 14:32

Thank you for the reply!

You said that:”It is outside of the enrolment period but being a recent immigrant should allow you to enroll”.

Where is the easy and the simple place to get the ACA plan?

Because I went to healthcare.gov and tried to create an account but they told that they weren’t able to verify my identity.And I don’t even know if I am eligible or not.

Your advice will be helpful to me.

Once again thank you!

March 23, 2016 at 14:45

Use the healthcare.gov site to get assistance in your area – you can get a listing of people that can help you.

April 3, 2016 at 08:22

Hi Brit,

If a person plays without a middle name and fill the ds260 with his full names (middle name) as in his passport and birth cert as always advised by you..he presents a statutory declaration for the names on the day of interview does dis cost his visa?

April 3, 2016 at 15:06

Denials have happened in that sort of case – Ghana is particularly strict about that.

September 20, 2016 at 20:30

Hi Simon,

Thanks a lot for your invaluable information and help.Your blog provided me with tremendous insights along my journey since I had been selected in DV in May 2015, and up till landing in the US in June 2016.

Now, I have a question about health insurance.I made POE in June 2016, but returned to my home country to arrange for the permanent move to the US in Jan 2017.My wife is pregnant, and her due date is expected to be in March 2017.Can she apply for health insurance that would cover child birth ? (expected to cost in the US a daunting amount of about 10-15 K $, because it’s caesarian)

Someone told me that she can’t get insurance because pregnancy is considered a pre-existing condition, and insurance companies don’t cover such cases.

Your opinion is highly appreciated.

Thanks,

Mo.

September 21, 2016 at 03:27

A key aspect of ACA (Obamacare) was that insurance companies offering ACA compliabt policies cannot refuse cover for pre-existing conditions. So – buy a plan through healthcare.gov and she will be covered.

September 26, 2016 at 20:52

Many thanks

December 26, 2017 at 23:30

Hi Brit, I am badly seek and I don’t have medical insurance coverage. I got green card via diversity visa what is your recommendations.

December 27, 2017 at 01:57

You get insurance BEFORE you get sick. So – I don’t have any recommendations if you didn’t follow my earlier advice!

August 10, 2018 at 19:07

Thank you Brit for the info. I am a little confused though.

I read in some articles that LPRs must wait 5 years until they make use of Madicaid and other articles say that we can apply as soon as we get our GC.

And also, if I choose not to get insurance and I pay a penalty is that considered an offense or misdemeanor because health care is mandatory?

Thanks

August 10, 2018 at 20:36

You need to pay your way. You are not supposed to draw from public resources that you have not contributed into. Make an appropriate plan. There are new laws being proposed that could affect people who use subsidized government programs, so come with the intention of working hard and paying for health care.

March 9, 2019 at 10:41

Dear Brit, its little complicated to understand the whole insurance procedure as a new immigrants me and my family has to take Obamacare or some private insurance. Because in start we will not have jobs so how much we have to pay and for how long we have to pay. Secondly I need your private email address to talk to u if u grant me favour.

Regards

March 9, 2019 at 15:14

Do some research on healthcare.gov about plans available.

Email (if really needed) britsimon3 at gmail

October 22, 2019 at 08:15

Hi Britsimon,

I watched your video & also went thru your article and state.gove website

that explain the healthcare .. still have some concern

My interview will be Mid Nov.

Am planning to use the link you provide to buy healthcare insurance for me and my family (3 member)

Basically my question is am planning to buy only for 3 month. As will stay in US for sometime and then come bk to finish everything here(UAE) and then go back again to US

Please advice

1-Should i get healthcare for entire year 364 days or wait till i land in US(after visa approved)?

or

2-It’s mandate before i’ll be interview by the consular? {or just to convince him am capable to buy}

Thanks a lot

And sorry for the long story

October 22, 2019 at 23:10

You will be going through the process before we know much about the new requirement. At this point we can only guess about it. So – your plan sounds OK, and if you have return flights, they should only be concerned about the period of the initial trip. However, as I said – nothing is sure yet.

2. I don’t know.

October 23, 2019 at 07:25

thanks

i’ll let you know what happened by then

as you said its something new.

December 2, 2019 at 02:23

hello brit my husband and I are 60 years old both of us, I can enroll in medicaid if I am a new immigrant of the DV lottery 2019, I currently do not have a job or any income yet, and many people have told me that it is not convenient Enroll in that insurance because it is not paid, and therefore it is considered a government aid, and that is why it would harm me later for when I can opt for citizenship. On the other hand, the deadline to enroll in insurance expires on December 6, and if I don’t sign up they tell me they can fine me later. Please can you confirm if I can enroll in this insurance?

December 2, 2019 at 02:33

hello brit my husband and I are 60 years old both of us,Can we enroll in medicaid if we are new immigrants of the DV lottery 2019? ,we currently do not have a job or any income yet, and many people have told me that it is not convenient Enroll in that insurance because it is not paid, and therefore it is considered a government aid, and that is why it would harm me later for when I can opt for citizenship. On the other hand, the deadline to enroll in insurance expires on December 6, and if I don’t sign up they tell me they can fine me later. Please can you confirm if I can enroll in this insurance?

2 Pingbacks

December 2, 2019 at 04:40

There are risks of enrolling in Medicaid because there have been recent changes about GC holders who take forms of public assistance. So – my recommendation would be not to take it. You should really have come here with a proper plan on how to support yourself, including paying for health insurance.

September 21, 2020 at 23:54

Dear Brit, if your job is not providing insurance for you, can you buy one and if yes what are the recommended companies to get one?

September 22, 2020 at 02:48

Yes you can. If this won’t be a short term choice, then you should buy a plan via healthcare.gov.

November 30, 2020 at 15:18

Now that I’ve read this article I am reconsidering my immigration plans :). I got one question: How much should one be under insurance in order to get the coverage benefits, like, if I subscribe to an insurance plan after getting ill but before needing to see a doctor, will I get the same benefits?

March 23, 2021 at 17:12

Hi Brit,

Just a quick question about insurance. Interview is in April. Should insurance be purchased before the interview, or is it ok to show proof of ample funds to purchase private insurance after entering the US. Should I take evidence of some plans that I may choose to enroll in once arriving? Thank you!

March 24, 2021 at 05:46

No proof of insurance is necessary.